- Extension off unit products toward the fresh new very first-lien HELOC

- Aim an enormous erican homeowners rather than a home loan)

- Flexible terms and conditions in addition to three-12 months draw period and you may prospective ten-seasons appeal-merely fee period

- Phased federal rollout bundle, available today inside the seven claims

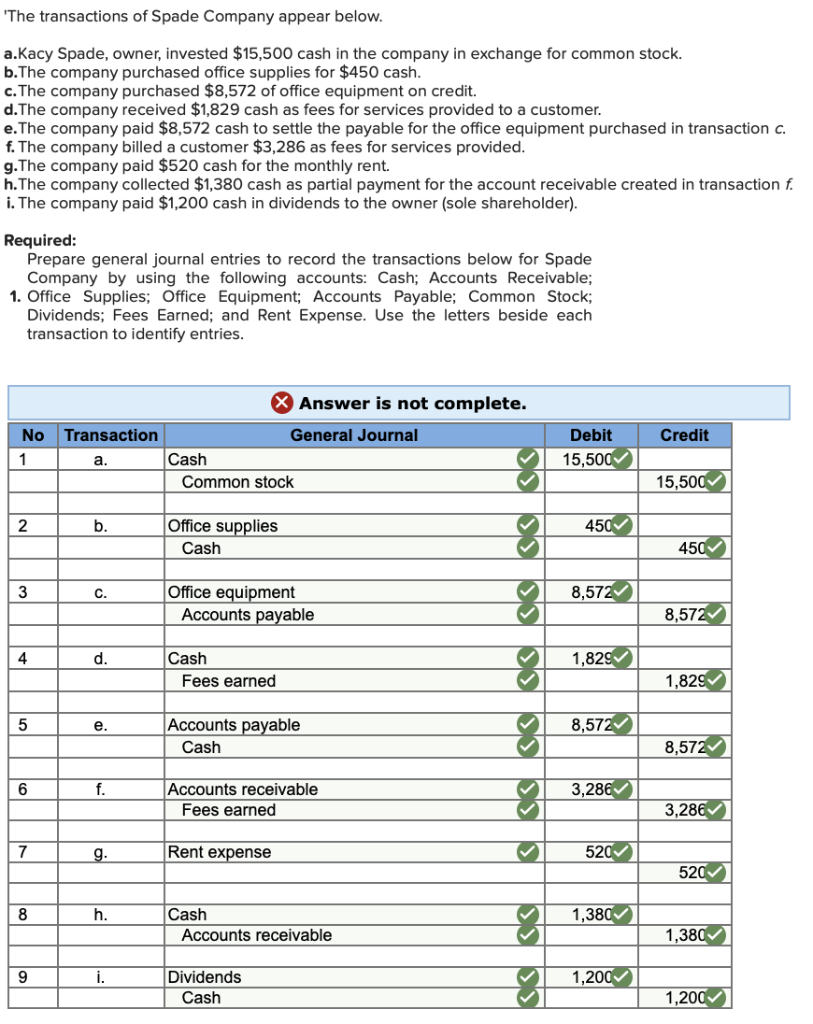

- Nothing.

Information

of American homeowners financial-free, this product tackles a substantial unexploited possibility. The fresh new versatile terms and conditions, plus a beneficial step three-season draw several months and you can potential 10-year desire-merely repayments, allow it to be a stylish option for residents seeking exchangeability. This expansion you will definitely broaden LDI’s cash avenues and you will probably boost its market share yourself equity credit place. Yet not, new phased rollout means suggests cautious optimism, allowing the business to check and improve the item just before a complete federal launch. Dealers is monitor the product’s use speed as well as influence on LDI’s financials from the coming quarters.

The time out of loanDepot’s equityFREEDOM Very first-Lien HELOC discharge are smartly sound. That have home owners standing on list degrees of guarantee and you can against rising expenses, the demand for instance factors tends to raise. The new item’s flexibility provides certain consumer need, from home renovations to help you debt consolidation, potentially broadening its attract. The first rollout from inside the eight states, plus biggest markets for example California and you will Florida, allows for a controlled extension and you may business assessment. This method could help LDI hone the offering based on very early use models till the structured federal extension of the late 2024. The success of the item you will somewhat perception LDI’s aggressive condition on the changing house security business.

Which item’s judge build you will lay a beneficial precedent for the very same products in the business

The brand new equityFREEDOM Basic-Lien HELOC introduces some legal considerations for both loanDepot and you can users. Because the an initial-lien product, it will take consideration over any subsequent liens, probably affecting borrowers’ upcoming financial support options. This new mention of the potential tax deductibility was prudently accredited, acknowledging brand new complexity from taxation implications. The fresh new varying words around the claims stress the need for careful regulatory compliance. LDI must ensure obvious disclosure regarding terminology, particularly concerning your attention-only period and you can next amortization. While the product increases across the nation, becoming up on county-specific financing legislation was extremely important.

IRVINE, Calif. –(Business Wire)– loanDepot, Inc. («LDI» or «Company») (NYSE: LDI), a number one supplier of products and qualities one electricity the new homeownership journey, is continuing to grow its equityFREEDOM equipment room to add a first-lien family guarantee credit line (HELOC). The fresh new HELOC lets the fresh

away from Western homeowners in the place of a home loan step 1 in order to use using their house’s security having higher costs like family renovations or college or university university fees, or perhaps to consolidate higher attention personal credit card debt. They adds another type of powerful monetary device so you’re able to loanDepot’s collection of products and services one hold the existence homeownership journey of the people.

«Residents are sitting on unmatched amounts of security immediately, such people who no further carry a mortgage,» told you LDI President Jeff Walsh. «But not, also in the place of a home loan, of many feel the pinch regarding ascending expenses, including insurance policies and assets fees, and therefore set much more tension for the monthly costs. This is why we’ve got additional the first-lien substitute for our very own guarantee lending collection to support the customers from the https://paydayloanalabama.com/remlap/ totality of its homeownership travels, not merely for the lifetime of its home loan.»

The capability to utilize equity try a major benefit of homeownership as you can reduce the price of borrowing for large expenses – and you can, in some instances, the interest can be tax-deductible dos . A first-lien HELOC is for individuals who don’t provides an existing financial to their home 3 .

This new equityFREEDOM Earliest-Lien HELOC allows including borrowers to get into this new guarantee within their residential property which have flexible terms which include good about three-year draw period, and you may, for the majority says, a beneficial 10-year desire-merely percentage several months accompanied by an effective 20-season amortizing fees term cuatro .

Comentarios recientes