After you buy property, you would like cover to go with it. Financial Term life insurance 1 might help cover what is most likely among their family’s main assets if you are paying out of or cutting your real estate loan if there is your demise.

Financial Term life insurance try underwritten by Canada Existence Assurance Organization (Canada Lives). Acquisition of so it insurance policy is elective which is not essential to help you receive people CIBC product or service.

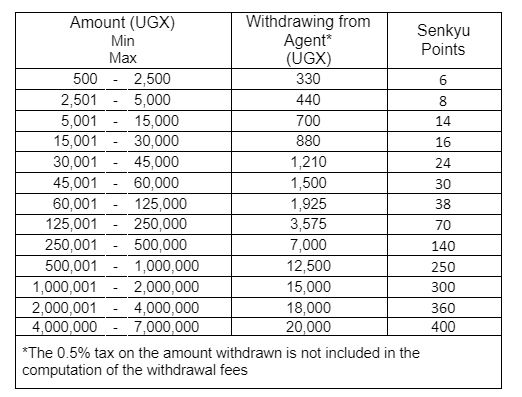

The Home loan Term life insurance premium is dependant on how old you are towards date of the insurance app, the initial covered quantity of your mortgage additionally the relevant advanced speed in the price dining table lower than.

Financial Term life insurance monthly superior prices for each and every $step one,000 of first insured level of the mortgage (relevant taxes would-be added to your own advanced):

Your own month-to-month Home loan Coverage premium = the initial covered level of their mortgage ? 1,000 ? applicable advanced rates.

Crucial data files

Their Certificate out of Insurance often secure the full details of their publicity, in addition to benefits, costs, qualification conditions, constraints and you may exclusions.

Tip: Obtain the proper execution by the proper-clicking brand new file and interested in Cut link once the. Then you’re able to unlock they using Adobe Acrobat Reader.

Factual statements about CIBC

CIBC receives costs on insurance carrier, The newest Canada Lifetime Promise Organization, getting taking functions to your insurance provider out of it insurance. Also, the risk within the category rules could be reinsured, entirely or in region, in order to a beneficial reinsurer connected to CIBC. The new reinsurer brings in reinsurance income under it arrangement. Agencies producing that it insurance rates with respect to CIBC get discovered settlement

Frequently asked questions

- You have got answered No to any or all relevant health issues for the app; and you will

- Your own CIBC Mortgage loan has been accepted.

In every other situations, this new insurance provider (The brand new see for yourself the website Canada Existence Promise Organization) commonly comment your application. In the event the application is accepted, the new insurance company will counsel you in writing of your date the insurance policies starts. In the event the software is maybe not acknowledged, the insurance company will give you a notification of decline.

Coverage would also avoid for a lot of other factors. For a whole a number of factors, refer to this new Certification out-of Insurance coverage to have CIBC Mortgages (PDF, 310 KB) Reveals from inside the an alternate screen.

A coverage benefit won’t be reduced in the event that:

There are many more limits and you may exclusions. Getting a whole list, refer to the latest Certification of Insurance policies getting CIBC Mortgage loans (PDF, 310 KB) Opens when you look at the a special screen.

30-date comment several months:

You really have 1 month on go out you can get your own Certification away from Insurance rates to review your own publicity and determine if this match your needs. For those who cancel their publicity in this 29-day review period, might located an entire refund of any superior repaid.

Get started

For more information on tool conditions and terms or subsequent recommendations, name CIBC’s Collector Insurance rates Helpline at step 1-800-465-6020 Opens up your cellular telephone application. .

Small print

step one Mortgage Life insurance coverage try a recommended creditor’s classification insurance underwritten by the Canada Lifestyle Warranty Organization (Canada Existence) and applied of the Canada Life and you may CIBC. CIBC receives charge regarding Canada Lifestyle getting providing functions so you’re able to Canada Lifestyle off this insurance coverage. Including, the risk within the class insurance policy is generally reinsured, in whole or in region, to help you a great reinsurer affiliated with CIBC. New reinsurer earns reinsurance earnings under this plan. Agents generating that it insurance coverage on the behalf of CIBC will get discovered settlement. Which insurance is at the mercy of qualification criteria, limits and you will exclusions (being issues whenever benefits was limited or otherwise not paid off). Towards over conditions and terms, review brand new attempt Certificate out-of Insurance rates (PDF, 275 KB) Opens during the another window. . You could get in touch with Canada Lifetime during the step one-800-387-4495 Opens your mobile phone application. . O r you can visit canadalife Opens in the a separate screen. . Everything throughout these pages was general just. Services its have can get changes at any time. If there is discrepancy amongst the suggestions and you will examples provided towards this site along with your Certification of Insurance coverage, the Certification out-of Insurance coverage is available.

Comentarios recientes