The money, which have been issued as a consequence of FHLB Dallas member First Federal Financial from Louisiana, will be regularly let locals obvious heirship or name activities to their qualities and safe a might.

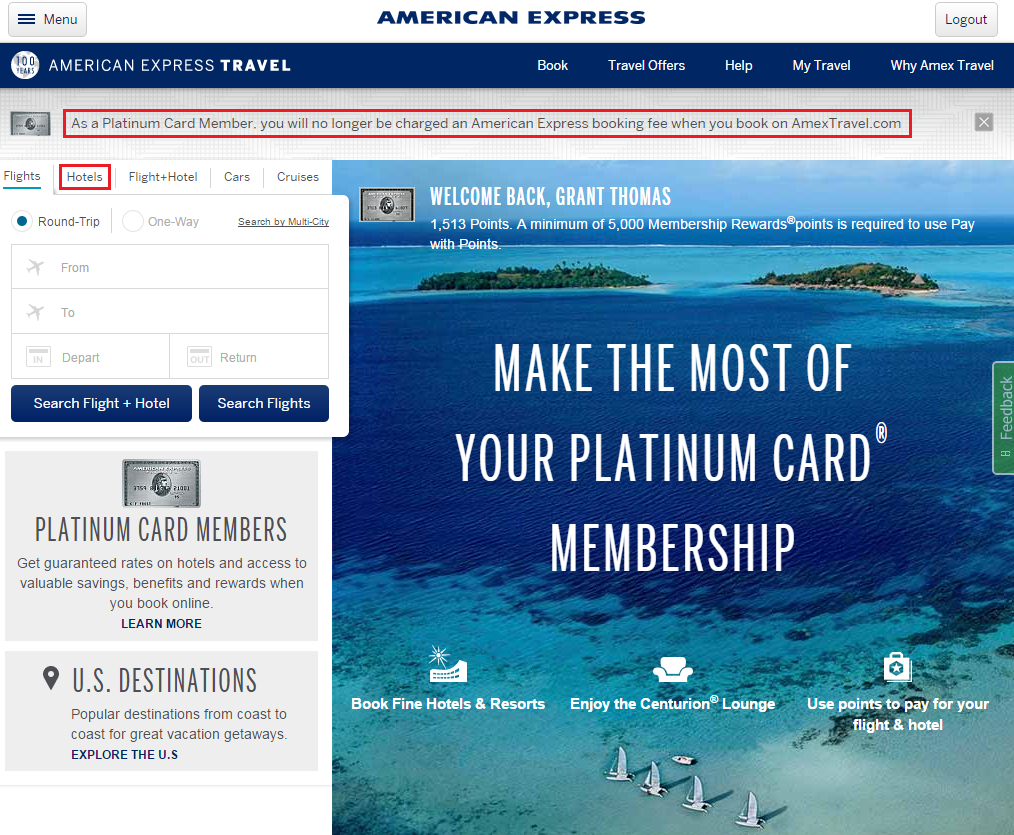

CRA Director Melissa Dickson away from Basic Federal Lender away from Louisiana (Left) merchandise good $75K ceremonial see around FHLB Dallas’ Heirs’ Possessions Program in order to Government Director Charla Blake out of Opportunity Make a future (Center) and Executive Director Genia Coleman-Lee out-of Southwestern La Laws Heart.

Heirs’ assets refers to possessions passed on in the place of a may or court records of control. Due to the fact house is handed down, per straight age bracket basically causes much more heirs getting set in brand new heredity. Its lack of an action or commonly can make it even more complicated to get an obvious term to help you house otherwise belongings given that go out seats.

Lake Charles, Louisiana-situated PBAF usually allocate $50,000 so you can Southwest La Rules Cardio (SWLLC) in the way of direct buyer assistance. The remainder finance would-be used to perform instructional issue for public records lessons.

Unclear headings on homes and you can assets was a large problem in this part of Louisiana, especially in the lower- to help you reasonable-earnings people, told you Charla Blake, government director away from PBAF. Of the cleaning the newest label, this choice helps those who have struggled to purchase and you will own their homes pass on the assets, clearly and you will lawfully, once the generational wide range.

Frequent hurricanes provides busted of many Louisiana attributes, and you may too little money to possess fixes or difficulties with insurance policies companies stands rebuilding, pressing of several citizens in order to move around in. If you are PBAF qualifies and you may fits people with finance, brand new SWLLC will provide legal counsel and help some body support the label into the services.

As attorney working within less costs, money will cover the new center will cost you sustained in the act, allowing me to flow qualities on the heirs and you can give Louisiana customers returning to its teams, said Genia Coleman-Lee, manager director out of SWLLC. These finance offer more than simply a place to stay; they assist some one go back home.

Somebody since very first times of PBAF, First Government Bank away from Louisiana is definitely in search of an approach to develop its dating.

Partnering which have Investment Generate a future as well as the Southwestern Louisiana Law Center on the newest Heirs’ Possessions Program allows people in our area to make a much better tomorrow on their own and you can generations to come, said Very first Government Bank out-of Louisiana’s CRA Director Melissa Dickson. It shows our seek to help our groups expand thanks to homeownership americash loans Penrose and you will economic physical fitness.

The audience is delighted you to definitely players such as for example Very first Government Bank from Louisiana are utilising the application to simply help its teams create a secure future of the paying heirship things, told you Greg Hettrick, senior vice-president and you will director from Neighborhood Financial support on FHLB Dallas

Regarding during the capital round, communities you certainly will receive around $75,000. Awardees provided sensible homes contacts, society creativity teams, judge help teams and you will a beneficial school. When you look at the 2024, FHLB Dallas has increased their allotment so you can $2 mil having groups entitled to discovered to $100,000 for every.

I am pleased you to definitely a bank as big as FHLB Dallas most pays attention so you can the agencies while offering into demands from all of the communities they provides, told you Ms. Blake. Brand new Heirs’ Property Program was made for all of us which have challenges getting otherwise thriving in order to properties and it will surely truly assist nonprofits and you will someone residing in smaller or rural organizations.

The following app screen for the Heirs’ Possessions Program honours reveals September step three and closes toward Sep 31. Recipients need to be from inside the FHLB Dallas’ four-county Section off Arkansas, Louisiana, Mississippi, The newest Mexico otherwise Tx and you can meet with the program’s conditions. All of the financing is actually paid compliment of an enthusiastic FHLB Dallas user business.

Concerning First Government Bank off Louisiana Very first Federal Bank out-of Louisiana is actually an entire-solution, in your town owned community lender who’s got assisted generate new communities i suffice for more than 70 ages. Which have 16 workplaces already helping several parishes across the Southwest and you will Central Louisiana, it has users total retail and you may commercial things plus opportunities and you can insurance attributes to satisfy almost all their monetary need. See ffbla.financial to find out more. Affiliate FDIC, Equivalent Houses Financial.

Lake CHARLES, LOUISIANA, – The fresh Federal Financial Bank off Dallas (FHLB Dallas) possess provided a beneficial $75,000 Heirs’ Possessions Program grant to Venture Make a future (PBAF)

Regarding the Government Home loan Bank off Dallas The fresh new Government Household Mortgage Bank away from Dallas is one of eleven region financial institutions into the the fresh new FHLBank System produced by Congress when you look at the 1932. FHLB Dallas, which have full possessions out-of $128.step three billion by , are an associate-owned collaborative that aids houses and society innovation giving competitively priced money and other credit activities to around 800 players and you can related institutions in Arkansas, Louisiana, Mississippi, The Mexico and you can Tx. To learn more, head to our very own website at fhlb

On the Venture Create another Investment Generate the next (PBAF) is actually an effective nonprofit enterprise dedicated to exciting its address urban area because of high quality, reasonable domestic-control efforts. Their address area surrounds the fresh new parts North off Large Roadway in the River Charles, Los angeles. As well, PBAF also offers homebuyer guidance features you to put a very good foundation for economic success of homebuyers and this improves their ability to be successful along the future. In reality, PBAF has actually seen zero foreclosure towards any one of the land as the the first when you look at the 2001.

Concerning Southwestern La Laws Cardiovascular system New Southwest La Legislation Heart (SWLLC) is a great Modest Mode attorney which provides affordable court help men and women persons who do not qualify for 100 % free legal advice. A sliding percentage scale can be used to determine the costs to possess icon. Legislation Center could have been serving new underprivileged organizations off Southwest Louisiana since 1967 having measurable victory and are also happy with this new strong customs out-of perfection, guaranteeing precisely the highest quality of services so you can readers.

Comentarios recientes