A guide to Home Collateral Personal line of credit

With regards to money biggest expenses, such as for instance family renovations otherwise studies, of many home owners turn-to a home Guarantee Personal line of credit (HELOC). Exactly what exactly is actually a good HELOC, and exactly how will it performs? Contained in this complete publication, we shall explore the field of HELOCs, exploring what they are, how they vary from other sorts of funds, additionally the positives and negatives of utilizing that it economic unit. Whether you are a citizen given an effective HELOC or simply interested about it form of borrowing, this guide provides you with the data you will want to make told behavior.

What exactly is good HELOC?

A home Equity Credit line, or HELOC, is a type of financing enabling residents so you’re able to borrow against brand new security he has accumulated within their assets. Guarantee refers to the difference between the modern market price from property and also the a fantastic balance on one mortgage loans otherwise liens. HELOCs are usually covered of the borrower’s domestic, making them a variety of next financial.

As to why Imagine a good HELOC?

An excellent HELOC is going to be an effective financial unit getting home owners. Permits you to definitely make use of the new collateral you have built up in your home, providing a way to obtain loans for biggest expenses. This really is including useful residents who are in need of to finance high methods, particularly domestic renovations or education expenses.

How is actually Equity Computed?

Equity are computed from the deducting the fresh new the equilibrium for the one mortgage loans otherwise liens throughout the latest ple, in the event the house is worth $3 hundred https://www.clickcashadvance.com/installment-loans-mn/victoria,000 and you’ve got a great mortgage balance from $2 hundred,000, you have got $100,000 in collateral.

Why does a great HELOC Vary from a timeless Home loan?

As opposed to a classic home loan, in which the debtor get a lump sum of cash upfront, a good HELOC will bring a beneficial rotating line of credit which are utilized as required. Because of this consumers is withdraw funds from the fresh new distinct borrowing several times, up to a fixed restrict, throughout the what exactly is known as the draw several months. The fresh draw period is usually around 5 so you’re able to ten years, following the brand new borrower enters the latest cost period, during which they’re able to not withdraw money and ought to begin settling the a good equilibrium.

How an effective HELOC Performs

To know just how a great HELOC functions, consider an example. Guess you own a property value $three hundred,000 and just have a fantastic mortgage equilibrium of $two hundred,000. This means you have got $100,000 within the collateral. For many who qualify for an effective HELOC that have a max loan-to-worthy of ratio away from 80%, you could accessibility to $80,000 within the borrowing.

The new Draw Several months

Inside mark period, you can acquire in the credit line as needed. For-instance, if you’d like $20,000 to have a house reount and use it for your expenses. The eye towards lent matter usually accrue and can you would like to be paid as well as the dominant harmony.

New Cost Several months

Following the mark several months concludes, you enter the cost period. During this time period, you might not any longer withdraw money from the latest HELOC and ought to begin paying off the brand new a great balance. The new fees several months can differ, but it’s usually up to ten to 20 years.

Rates of interest and HELOCs

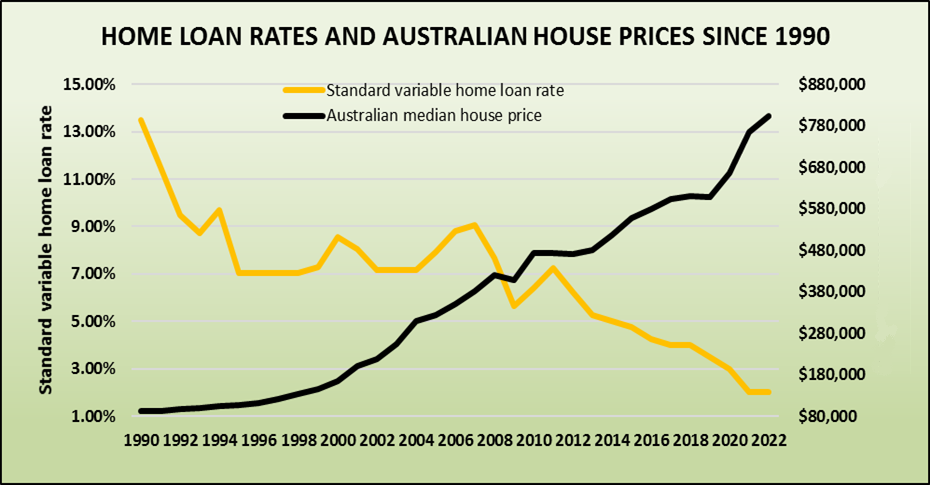

The eye costs to your HELOCs are usually varying, definition they’re able to fluctuate over the years. The speed is normally associated with a standard, for instance the prime price, in addition to good margin. As a result as the benchmark price change, thus really does the rate on the HELOC. It is very important meticulously consider the potential for interest increases when deciding to take away a good HELOC.

Comentarios recientes