*These pages is for informational objectives, with no judge really worth. The outcomes shown right here would be considered simply since the a simulation.

Dining table out-of Articles

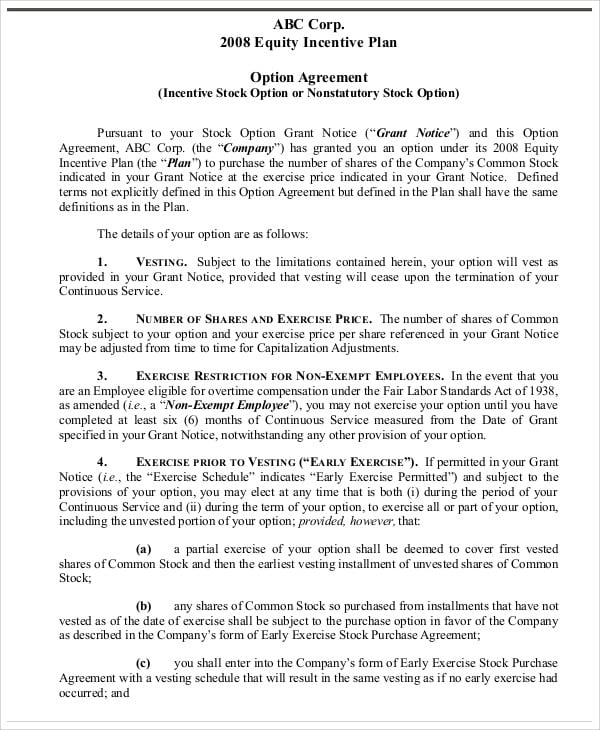

- In regards to the mortgage simulator

- Utilizing the mortgage simulator?

- What is a loan?

- What exactly is a loan to own?

- What are the benefits and drawbacks from financing?

- Mortgage analogy

What is actually that loan?

Mortgage is the label familiar with specify a price produced from a single individual a different sort of as paid down posteriorly. However, our company is talking about economic lending, in which what is borrowed is currency, however, loan is actually a generic title and certainly will be studied to possess a number of other some thing, a good example will be a neighbors lends an effective screwdriver to some other next-door neighbor hoping to found it just after explore.

The fresh new bank loan can be produced from person to an alternate, but it is more widespread that it’s created from good financial institution in order to one or courtroom organization. Once the financing will never be repaid quickly, the most famous mortgage commission system is the latest fee from inside the installments and therefore the typical would be the fact focus are energized to your the latest fee on the loan.

What exactly is that loan having?

The borrowed funds can be used for a couple of things, a trip, repaying a financial obligation, to buy some thing, that is, it generally does not have a particular purpose. But there is a type of loan which have purpose, resource, it has got the precise purpose while the financing regarding a home where there is an agreement so you can mortgage the bucks especially for one mission.

Which are the mortgage models?

The kinds of fund offered get go from nation to nation, certain particularities can be seen in certain countries and not during the other regions. But we could number particular very common types of money, pick some of all of them:

Among the great things about taking out fully a loan we have the fact that it is a powerful way to solve an emergency as if you don’t have the cash you prefer in the moment, into loan this might be solved.

Even as we mentioned prior to, you will find some style of funds that are offered in order to meet more demands, which are often very helpful if you are searching so you can buy a house or pick a car plus don’t have payday loans online same day West Jefferson the currency you would like at the moment.

However, including whatever excellent, finance also provide the perhaps not-so-a region, and we must be aware of some info. That loan taken out at a lending institution will most likely include desire, along with your really works right here and get familiar with one attract. If your rate of interest is actually higher you might be purchasing a great deal more than just your acquired while the financing in the end, the right isto view if it’s worth it.

The greater amount of payments you choose to pay the loan, the more appeal you’ll have to spend as well. Keep in mind one to!

Anything else to look out for are the rules to the mortgage. Find out if you will have a superb to have slowing down a cost to get ready yourself best. When you take from loan, inform yourself regarding other charges and you will taxation which can be additional into the amount you’ll have to pay.

A few of these can be seen just like the disadvantages, very look a great deal prior to taking out a loan and come up with a knowledgeable decision.

Mortgage analogy

Marina wants to take a trip abroad who would rates $8, and pay back an obligations with her aunt from the amount of $step 1,, therefore she made a decision to sign up for that loan regarding bank in which she’s a free account.

Before you go towards financial, Marina chose to manage financing simulation utilizing the mortgage simulation on the site CalculatorForUs to get a concept of just how much she’d need to pay when trying to get a loan into the the degree of $9,, a price who assist to pay their particular sibling and make your vacation.

Marina saw on the bank’s website your interest rate to own an unsecured loan is actually several% annually, and therefore she made a simulation getting the degree of $9, at a level off twelve% annually and you can looked at the fresh percentage in the 12 payments.

The end result revealed that the fresh new installment payments might possibly be well worth $, and this Marina noticed highest to own their money, therefore she made a decision to simulate 18 installments.

Even though the influence demonstrated a slightly large full add up to become paid than before, Marina preferred the worth of the fresh cost, which had been $, whilst do easily fit into their particular pouch instead diminishing their earnings.

Pleased with the result of the brand new simulator, Marina went along to their unique bank to request the loan, which in fact had more charges and taxes, but is actually most nearby the simulator generated on the internet site CalculatorForUs.

Comentarios recientes