Instead of a mortgage banker, brokers do not financing the mortgage the help of its very own currency, however, run part of several dealers, such as home loan bankers, S & L, financial institutions, or investment lenders.

Mortgage Insurance rates: Insurance bought of the a borrower so you can ensure the lending company or even the government against losings should that loan getting standard. Would be to a borrower pay-off a national-insured loan just before readiness, brand new borrower I: (otherwise Personal Mortgage Insurance) try repaid towards the those individuals loans that aren’t government-covered and whose LTV are more than 80%. When a debtor provides collected 20% of its house really worth since the guarantee, the lending company https://paydayloanalabama.com/hartselle/ We on borrower consult. Please note you to such as insurance cannot constitute a kind of life insurance coverage, which pays off the mortgage in case there is passing.

Real estate loan: That loan, hence uses a house due to the fact safeguards or equity to take care of payment, should a borrower standard on terms of the new borrower loan. The mortgage or Deed away from Faith is the borrower arrangement to hope their house and other a home just like the coverage.

Mortgagor’s Affidavit: A file utilized by the Government Homes Management in order to ensure a good loan, otherwise by the Pros Management to ensure that loan, or by an exclusive Home loan Insurer so you can guarantee a loan. It document as well as states in the event a borrower intentions to consume the house or property while the a primary home. In addition it find if the a property is located in an alternative Flood Risk Area.

MIP: (otherwise Home loan Premium) was paid for the authorities-insured money (FHA or Va finance) no matter what a borrowers LTV (loan-to-value)

Bad Amortization: Amortization where a cost generated are shortage of to pay for done fees off a loan in the the termination. Always is when a rise in the new payment is restricted by a roof. That part of the fee, that should be paid, try put in the remainder balance owed. The balance owed could possibly get increase, in lieu of decrease, across the lifetime of the borrowed funds.

Refinance Exchange: The whole process of repaying you to definitely mortgage towards proceeds from another type of mortgage, generally speaking utilizing the same assets since protection into the new financing

Note: A signed document taking an obligations and you will a pledge to settle for each and every the fresh new terms intricate. The fresh Note you can expect to consist of: target of the house under consideration, loan amount, financial, interest, big date where the very first commission of your own the financing are due, go out out-of past percentage, where to post the brand new money, monthly obligations, and you may payment energized in the event that paid back late.

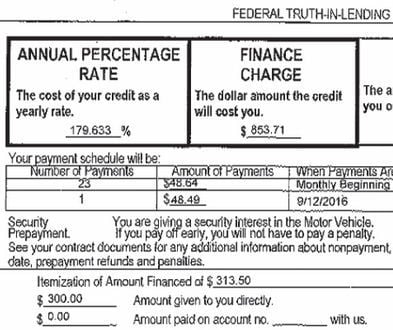

Commission Schedule: The fresh dollars numbers on the percentage agenda show prominent, desire and mortgage insurance rates (if applicable) along the lifetime of financing. These types of figures does not echo fees and you can insurance rates escrows otherwise one short term pick off costs contributed by provider.

Rewards Declaration: This file says to individuals how amount of brand new incentives regarding a vintage mortgage are hit. Usually the overall benefits amount about report tend to match the payoff number listed one to the fresh HUD-1 report. It statement include, prepayment attract, elective insurance policies, costs needed for incentives, funds to be credited, financing is employed.

Prepaid service Fund Costs: Specific loan charges particularly financing origination fees (points), loan dismiss (discount issues), buy-downs, and you may prepaid desire (strange day focus), handling costs, an such like. is defined as prepaid fund charges.

Quitclaim Deed: An action one transfers, as opposed to assurance off control, any kind of attention otherwise title an effective grantor might have at that time this new conveyance is made.

A residential property Settlement Steps Act (RESPA): A federal rules that really needs lenders to add individuals with information towards settlement (closing costs).

Comentarios recientes