A profit-out re-finance takes this new security you’ve collected in your home and transforms they toward bucks. It can be a reduced-costs option to pay money for renovations. ( iStock )

Spring season and june usually are the brand new busiest times of the season getting homebuying, nevertheless the housing industry is not the merely material which is hot best now – very ‘s the market for house renovations.

Many People in the us invested more go out home from the early in the day season. It’s left them shopping for updating their houses to sometimes optimize comfort, offer even more capability on their space, or obtain homes willing to offer during the maximum speed.

In the event the domestic home improvements are on your own wish list and you you should never have sufficient cash on give to pay for all of them, you’re not out-of luck. There are some options for investment home improvements, along with refinancing your property.

Do i need to refinance to possess home improvements?

If you have collateral of your house, you might turn the you to definitely equity on bucks with a good cash-aside re-finance.

For the a timeless financial refinance, you never get any security out from the house. As an alternative, you have to pay of your mortgage with a new financing – usually to track down a diminished interest otherwise switch out-of a keen adjustable-rate so you’re able to a fixed-rates financial.

With a cash-away re-finance, you only pay of your current home loan having more substantial one. The essential difference between the borrowed funds number of the outdated home loan and you can new financing (together with closing costs and fees) can be a to make use of as you would like, including paying for home renovations.

How much cash ought i obtain by the resource for renovations?

The total amount you can use inside the a finances-aside re-finance relies on the worth of your property and exactly how much equity you have. Normally, residents cannot withdraw each of their collateral.

Very lenders limit the loan-to-worth (LTV) to 80%, meaning just after funds-aside re-finance, you need to still have 20% security leftover.

Case in point: You reside worthy of $eight hundred,000 and your existing mortgage equilibrium was $150,000. You take a separate mortgage to own $320,000 (80% of $eight hundred,000), and use $150,000 of the proceeds to settle your amazing loan. You’d use the kept $170,000 inside dollars to use for home improvements – or other mission.

Loan providers might have various other maximum CLTVs for next belongings, capital properties, and multiple-tool homes, therefore check with your financial due to their rules and you may restrictions.

What are the positives and negatives from refinancing to own renovations?

And make transform for the financial try a primary decision. Anyway, your home is probably your own biggest advantage, plus home loan is the premier obligations you ever before just take towards the. Also, its your location. This is why you will want to carefully check out the advantages and disadvantages.

Lower rates: Pricing to the mortgage refinance finance are usually less than the interest prices on domestic security fund otherwise home equity outlines out-of credit (HELOCs). You might also be able to get less rate than just you happen to be purchasing on your established home loan.

Accessibility cash instead depleting offers: A good 2021 questionnaire off LightStream found that 66% out of residents cite deals as his or her main funding origin for household building work programs. That is an intelligent circulate whenever you can pay for they, but residents is avoid using up their offers to help you remodel. It’s important to have an excellent disaster funds should you want it inside the a-pinch to cover a new rooftop otherwise an urgent assets tax comparison.

Enhance your residence’s worthy of: When you use your residence equity to pay for house home improvements, the individuals renovations could raise the selling worth of your residence and you may, in loan places Mulga turn, manage a whole lot more equity. Just remember that not all renovations raise family values.

It is possible to income tax masters: Mortgage attract are going to be taxation-deductible for people who itemize the deductions. Also, the money you’re taking from your security is not sensed nonexempt money.

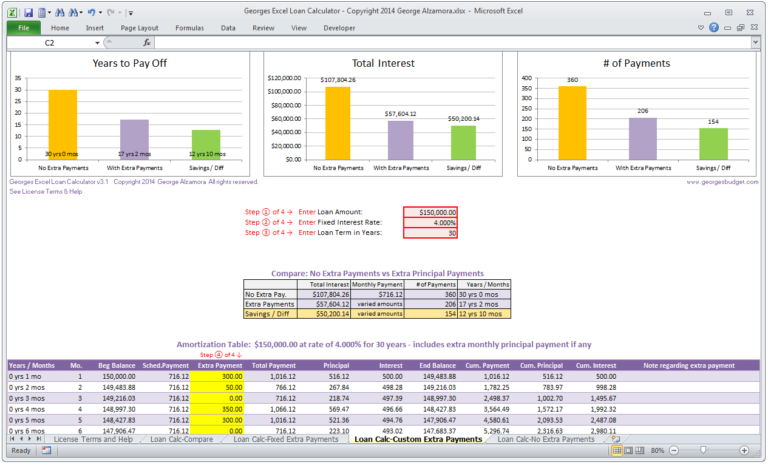

Potentially high mortgage repayment: When you take away a more impressive mortgage on your own family, you may get more substantial mortgage repayment as you are obligated to pay much more overall. For individuals who re-finance to the a smaller-name loan – from a 30-season so you can 15-year, instance – the monthly payment and you may boost. But when you features sophisticated borrowing from the bank you to definitely qualifies you into reasonable rate of interest available, your own monthly homeloan payment you will definitely drop off. It is best to run the latest amounts to ensure their the new commission won’t hurt you wallet.

Even more need for the long run: Regardless if it’s possible to lower your payment per month or continue it a comparable, refinancing to pay for renovations might charge a fee significantly more within the demand for the future. That is because a good refinance fundamentally restarts their mortgage repayment terminology.

Straight down desire isn’t secured: Basically, you should have a or higher level borrowing from the bank so you can qualify for an informed home improvement mortgage product sales. When your rates in your current home loan is already low, there’s no be certain that possible score a lesser price because of the refinancing.

Risk to your house: Contemplate, when taking guarantee out of your home, you lower your demand for the fresh new house’s well worth. When the a residential property opinions drop, you could end up due much more about your residence than its really worth. Which can allow it to be hard to sell your property otherwise refinance to the another mortgage. Plus, if you cannot make payment, your chance losing your home.

Must i refinance getting home improvements?

The choice to get a money-aside re-finance to have household renovations was an individual you to definitely. It depends in your total financial predicament, your goals, as well as how much collateral you may have of your property.

Including, if you’re considering a profit-away refi to get a lower life expectancy interest rate and you’ve got improvements for you to do, cashing aside guarantee might be a smart way to reach each other people requires.

But not, whether your interest rate towards the new loan is higher versus price you’re currently using, you should speak about choice to refinancing or hold back until you have got sufficient currency conserved to pay for the brand new restoration inside dollars.

How to be eligible for a property update re-finance?

- A minimum credit score of 640

- An optimum LTV regarding 80%

- An optimum personal debt-to-earnings (DTI) proportion from 45%, meaning all of your month-to-month loans payments, as well as your the brand new homeloan payment, must be lower than 50% of your monthly gross income

Comentarios recientes