- Down Costs: We fees % Annual percentage rate (dos.99 % monthly) for the our very own South Ca term loans. Our rates are some of the reduced off traditional lenders and we consistently overcome our very own opposition.

- Totally Amortized Loans: For each and every percentage Reduces your the dominating equilibrium. There aren’t any prepayment punishment.

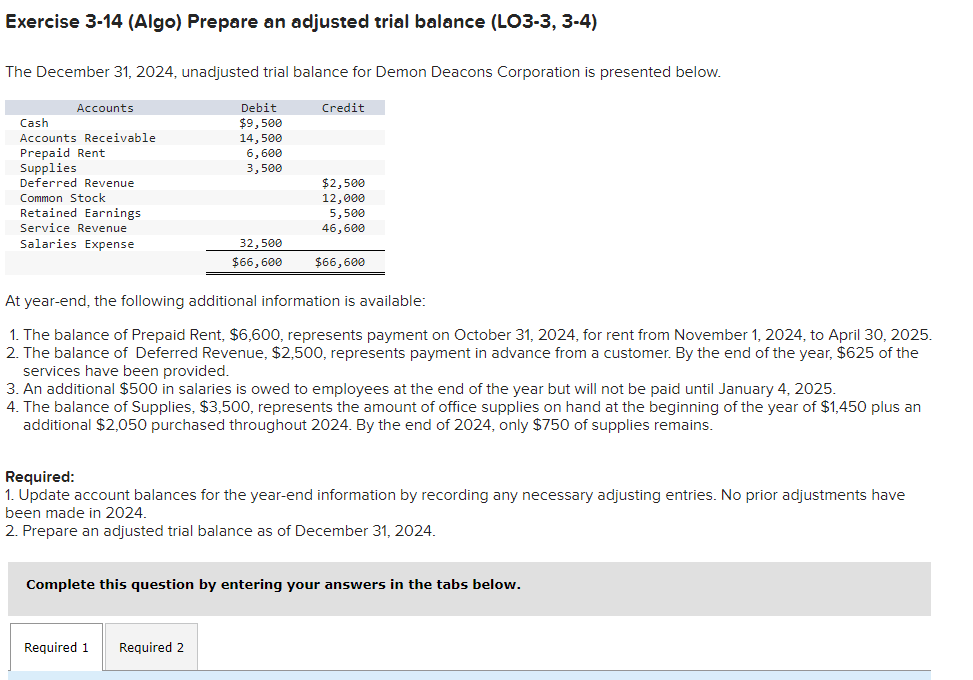

The latest chart below represents illustrative types of the expense of an excellent loan to help you a qualified borrower. If you have any questions, or would want additional information, please query. Ensure that your questions try responded totally. Be sure that you understand the conditions and can cost you of mortgage.

- There are no charges for making a lot more payments or prepayment.

- Apr was calculated considering most of the installment episodes getting away from equivalent duration.

- A lot more fees: Ca lien fee away from $ is actually funded. Prepaid Paperwork Fee is $ to possess loans $2,600 so you’re able to $4,999 or 5% getting money $5,000 or higher.

- Individuals are believed qualified with a credit rating off 690 otherwise greatest, dos and numerous years of employment and you may 3 in addition to many years at the its current address.

- Automobile Investment makes use of the FICO rating method when credit rating are a factor in deciding buyers credit history.

- Lowest amount borrowed try $2,.

There Idaho loans is times when there is a state under the new Customer’s Coverage however in Loan Plan, and you may visa versa

Copyright laws 2024 Funding Financial, Inc. | All of the Legal rights Kepted | Privacy | Loans made or arranged pursuant to help you California Funding Laws Permit 6038638

That loan Policy secures your own financial in addition to that you possess the house, but also guarantees brand new legitimacy, priority and you may enforceability of one’s lien of its mortgage, susceptible to the brand new exclusions and you may conditions put down on coverage

After you pick a house with all of cash-out of individual wallet, and you won’t need to borrow hardly any money to aid spend the cost, truly the only label policy try to pick is actually an Owner’s Policy, as you are alone with an intention about assets. But if you you desire that loan to help pay money for new property, their financial will need one to sign a mortgage getting a beneficial lien on your property to help you secure the loan. The financial institution will additionally require you to purchase a title rules insuring their lien on your property, which name plan might possibly be that loan Coverage. So, the easy means to fix the aforementioned real question is: You have to pick that loan Rules since your financial means that do so.

An owner’s Coverage guarantees your, since buyer and you will manager, that you individual the home, susceptible to the fresh new exceptions and you may conditions set out on the policy. New visibility appears to be an equivalent, but may feel different.

New Customer’s Policy was given about level of the acquisition cost of the house, secures the proprietor which he possess a great term towards the actual estate, and will capture exception to this rule into the purchase money home loan (among almost every other exceptions) in the Plan B of your own plan. That loan Policy try awarded on level of the borrowed funds into the assets, secures the lender your holder enjoys a great term towards home, and therefore the fresh lien of purchase-money mortgage is a appropriate and you will enforceable lien with the a home. While the one another term procedures guarantee the condition of new term, they have overlapping coverage, and thus there can be a good commonality away from chance into the both policies. But not only were there different organizations covered beneath the formula, but the appeal insured differ.

The mortgage Policy provides the lender and lender’s lien to your possessions, and will not render people safety or coverage towards the owner. An example of the issue in which there could be a declare under the User’s Coverage just will be the instance where here try a dispute between adjoining landowners about what location off the house edge range. In case your neighbor claims the property range most lies ten base inside your assets, that the driveway is really toward their residential property and then he aims to prevent you from making use of your driveway, that could be a potential losings beneath your User’s Coverage away from identity insurance policies, therefore the term team would safeguard the identity because covered. Alternatively, so the financial institution for a loss of profits under the Mortgage Policy, indeed there need basic feel a default according to the regards to the newest financial you to definitely impairs otherwise affects the new authenticity, priority or enforceability of their lien. So long as there is no default within financial, the lending company does not have any allege under the Financing Coverage. Therefore on over allege example, if you remain expenses the mortgage payments since name company is shielding your name, there isn’t any loss towards the bank because there is not any standard, and that, the lender has no allege lower than his Financing Policy.

Comentarios recientes