If you’re working a lot fewer occasions, it may be because your boss offers you quicker works or as you want to performs reduced. Although not, in the event the employer is actually to shop for shorter labor because of diminished consult regarding the labour sector, which can be because of market otherwise monetary course, which may affect your ability to succeed for making you to definitely alter.

In his instance, the income variances is confident

If it’s your selection of circumstances having caused the difference, possibly which is because of private situations-youre ageing otherwise their dependents need significantly more worry-that have to be solved to cause you to performs a lot more.

Identifying why you are straying out of your loans Mount Crested Butte funds is crucial so you’re able to identifying treatments and you may solutions. Getting those individuals causes relating to the new small- and you can macroeconomic factors that affect your position can make their feasible possibilities sharper. Graph 5.cuatro.step one lower than suggests exactly how this type of affairs can be blend resulting in an effective variance.

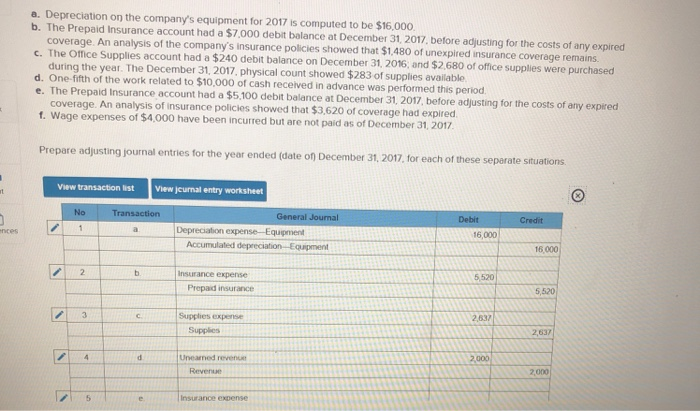

Shortly after 90 days, Jeff chooses to look at his funds variances to make certain he is on course. Their genuine outcomes for that time was detailed on following the desk.

Exactly how usually Jeff learn the fresh new funds variances the guy finds? He’s acquired one or two tutoring readers that invested in training through the prevent of your own college or university 12 months in the June; this new information can be used to to switch money. Their memorabilia company did really; the quantity out of transformation has not enhanced, nevertheless the memorabilia business seems to be up and costs are a lot better than requested. The collectibles organization is cyclic: economic extension and you may grows into the disposable revenues enhance you to definitely sector. Given the volatility off pricing where field, yet not, and the simple fact that we have witnessed no increase in this new quantity of conversion (Jeff is not doing a lot more team, only more successful team), Jeff does not make adjustments going forward. Rates has stayed steady, thus he will perhaps not to improve their questioned focus earnings.

His costs is actually as expected. The actual only real difference ‘s the consequence of Jeff’s choice to cut his take a trip and you may recreation plan for this present year (i.age., giving up their vacation) in order to counterbalance the can cost you of one’s roof. They are believe one financing cost having Oct, that actually make they reduced to accomplish.

With these changes, it turns out you to Jeff can be avoid this new personal debt whilst still being keep the financial support expenditure of your brand new rooftop. The elevated income one to Jeff can expect, along with his reduced expenditures (in the event that he is able to care for their handle), can money your panels nevertheless leave him having a while regarding discounts in the high interest family savings.

Or you you are going to only will works so much more

This case holds went on keeping track of, however. Particular improvements is owing to Jeff’s operate (lowering with the entertainment costs, letting go of their vacation, fostering the brand new tutoring members). However, Jeff comes with benefited of macroeconomic affairs which have changed so you can his advantage (ascending memorabilia costs), and the ones factors you will alter again so you can his drawback. They have attempted to become traditional on and also make changes in the years ahead, however, the guy is always maintain a virtually vision with the condition, particularly as he gets closer to deciding to make the relatively high investment expense within the October.

Possibly a difference can’t be corrected or is on account of a mini- otherwise macroeconomic foundation beyond your handle. In that case, you must to switch their criterion so you’re able to reality, which could indicate modifying expected outcomes if you don’t their biggest goals.

Variances also are steps of your accuracy of your projections: everything you study from all of them normally change your prices plus budgeting feature. The newest unexpected can always are present, although top you can acceptance what to anticipate, the greater amount of direct-and you will of use-your financial budget procedure would be.

Comentarios recientes